Are you looking for a reliable notary service? Bank of America notary services might just be the solution you need. Whether you're finalizing important legal documents or verifying signatures, notary services are essential for ensuring the authenticity and legality of transactions. Bank of America offers professional notary services that are trusted by millions of customers across the United States.

Notary services play a critical role in safeguarding important documents and transactions. From real estate agreements to power of attorney forms, notarization ensures that documents are signed willingly and by the rightful parties. Bank of America, as one of the largest financial institutions in the country, has made notary services widely accessible to its customers, ensuring convenience and reliability.

In this article, we’ll explore everything you need to know about Bank of America notary services. From understanding what notarization entails to finding a notary at your local branch, we’ve got you covered. Whether you're a first-time user or a frequent visitor, this guide will provide you with valuable insights to make the most of these services.

Read also:Astrella A Comprehensive Guide To Understanding And Utilizing This Revolutionary Technology

Table of Contents

- What is Notarization?

- Why Choose Bank of America for Notary Services?

- How to Find a Notary at Bank of America

- Types of Documents Commonly Notarized

- Steps Involved in the Notarization Process

- Costs and Fees for Notary Services

- Tips for a Smooth Notary Experience

- Alternatives to Bank of America Notary Services

- Frequently Asked Questions About Bank of America Notary

- Conclusion

What is Notarization?

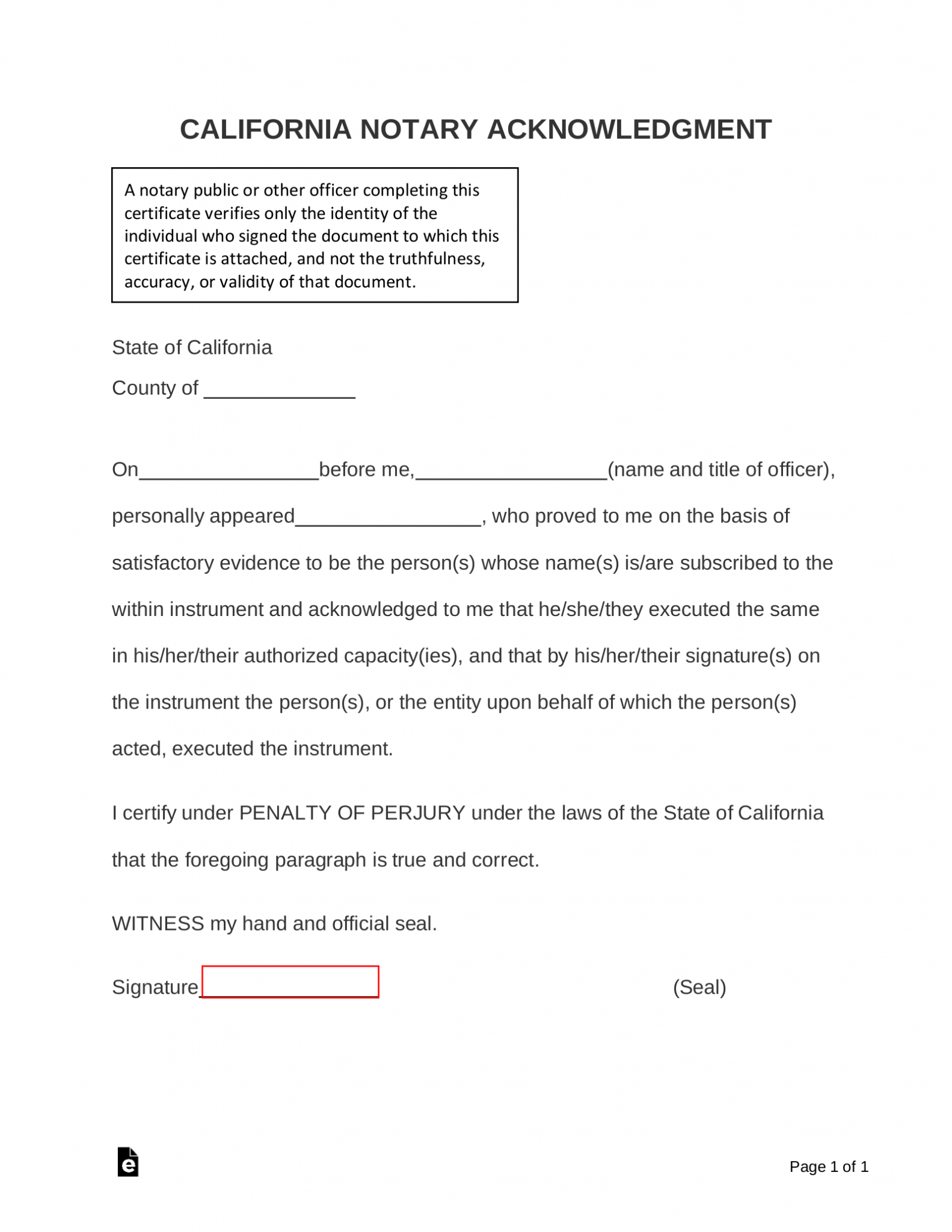

Notarization is a formal process where a notary public verifies the identity of signers and ensures that they are entering into agreements willingly and knowingly. This process adds a layer of security to important documents, making them legally binding and reducing the risk of fraud. Notaries are impartial witnesses who confirm the authenticity of signatures and certify that the parties involved understand the contents of the documents.

Role of a Notary Public

A notary public is an individual authorized by the state to perform notarial acts. Their responsibilities include:

- Verifying the identity of document signers

- Witnessing the signing of documents

- Administering oaths and affirmations

- Certifying copies of certain documents

Notaries are required to follow strict guidelines to maintain the integrity of the notarization process. This makes them a trusted resource for individuals and businesses alike.

Importance of Notarization

Notarization is particularly important for legal and financial documents, as it ensures that all parties involved are protected. Some benefits of notarization include:

- Preventing fraud by verifying identities

- Providing a legal record of the transaction

- Enhancing the credibility of documents

Why Choose Bank of America for Notary Services?

Bank of America is a trusted name in the financial industry, and its notary services reflect the same level of professionalism and reliability. Here are some reasons why you should consider using Bank of America for your notary needs:

Convenience and Accessibility

With thousands of branches across the United States, Bank of America makes it easy to find a notary near you. Many branches offer notary services during regular business hours, and some even provide extended hours for customer convenience.

Read also:Kendall Jenner The Rise Of A Fashion Icon And Her Impact On The Industry

Experienced and Certified Notaries

Bank of America notaries are trained professionals who are well-versed in the legal requirements of notarization. Their expertise ensures that your documents are handled with care and precision.

Trusted Reputation

As one of the largest banks in the country, Bank of America has earned a reputation for trustworthiness and reliability. Customers can feel confident that their documents are in safe hands when using the bank's notary services.

How to Find a Notary at Bank of America

Finding a notary at Bank of America is a straightforward process. Follow these steps to locate a notary near you:

Step 1: Visit the Bank of America Website

Start by visiting the official Bank of America website. Use the branch locator tool to find a nearby branch that offers notary services.

Step 2: Call Ahead for Confirmation

Not all branches may offer notary services, so it’s a good idea to call ahead and confirm availability. This will save you time and ensure that a notary is available when you visit.

Step 3: Prepare Your Documents

Before your visit, make sure you have all the necessary documents ready. Bring valid identification, such as a driver’s license or passport, to verify your identity.

Types of Documents Commonly Notarized

Bank of America notaries handle a wide range of documents, including:

- Real estate agreements

- Power of attorney forms

- Loan documents

- Wills and trusts

- Affidavits

These documents often require notarization to ensure their legality and authenticity.

Steps Involved in the Notarization Process

The notarization process typically involves the following steps:

Step 1: Present Valid Identification

You will need to provide a government-issued ID to verify your identity.

Step 2: Sign the Document in the Presence of the Notary

The notary must witness you signing the document to ensure its validity.

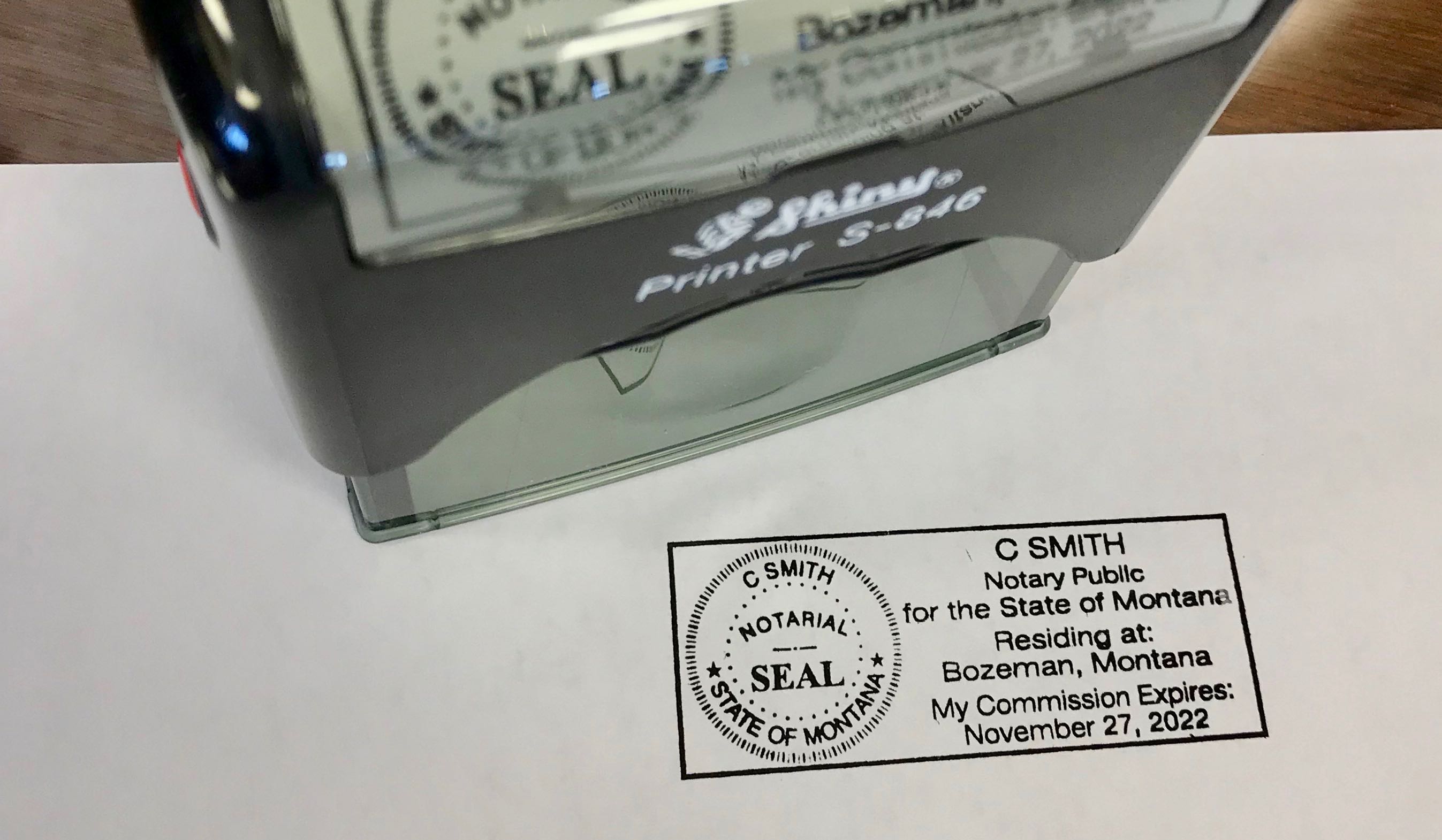

Step 3: Notary Completes the Certification

The notary will complete the notarial certificate, which includes their signature, seal, and the date of notarization.

Costs and Fees for Notary Services

Bank of America charges a nominal fee for notary services, which may vary depending on the location and type of document. It’s best to inquire about fees when confirming notary availability.

Tips for a Smooth Notary Experience

To ensure a hassle-free notary experience, consider the following tips:

- Bring all required documents and IDs

- Double-check the document for completeness before signing

- Arrive during business hours to avoid delays

Alternatives to Bank of America Notary Services

If Bank of America is not convenient for you, there are other options for notary services, including:

- Local banks and credit unions

- Mobile notary services

- Online notary platforms

Frequently Asked Questions About Bank of America Notary

Do I need an appointment for notary services?

No, appointments are generally not required. However, calling ahead to confirm availability is recommended.

What forms of ID are accepted?

Government-issued IDs such as driver’s licenses, passports, and state IDs are accepted.

Conclusion

Bank of America notary services offer a convenient and reliable option for individuals and businesses in need of notarization. With experienced notaries, accessible locations, and a trusted reputation, Bank of America ensures that your documents are handled with the utmost care and professionalism. Whether you’re signing a loan agreement or finalizing a legal document, Bank of America’s notary services can provide the peace of mind you need.

If you found this guide helpful, feel free to share it with others who might benefit from it. For more information, visit your local Bank of America branch or explore other resources on their website.