Table of Contents

Are you looking for a reliable and feature-rich checking account to manage your daily financial transactions? Noble Bank Checking Account might just be the solution you need. In today’s fast-paced world, having a dependable banking partner is essential for ensuring your financial stability and convenience. A checking account is the backbone of personal finance, allowing you to deposit, withdraw, and manage your money effortlessly. Noble Bank offers a robust checking account that caters to individuals and businesses alike, combining modern technology with traditional banking values.

With the rise of digital banking, many people are seeking accounts that offer seamless online access, low fees, and excellent customer service. Noble Bank has positioned itself as a leader in this space, providing a checking account that meets the needs of its diverse customer base. Whether you’re a student, a professional, or a business owner, understanding the features and benefits of a Noble Bank Checking Account can help you make informed financial decisions.

Read also:Julie Pitt Actress Model Latest News Photos

In this article, we will explore everything you need to know about Noble Bank Checking Account, from its benefits and features to the steps required to open one. We’ll also discuss how to manage your account effectively, the fees involved, and the security measures in place to protect your funds. By the end of this guide, you’ll have a clear understanding of why Noble Bank Checking Account is a top choice for managing your finances.

What is a Noble Bank Checking Account?

A Noble Bank Checking Account is a versatile financial tool designed to simplify your everyday banking needs. Whether you’re paying bills, making purchases, or depositing your paycheck, this account provides the flexibility and convenience required for modern living. Unlike savings accounts, which are primarily used for storing money, checking accounts are transactional accounts that allow you to access your funds quickly and easily.

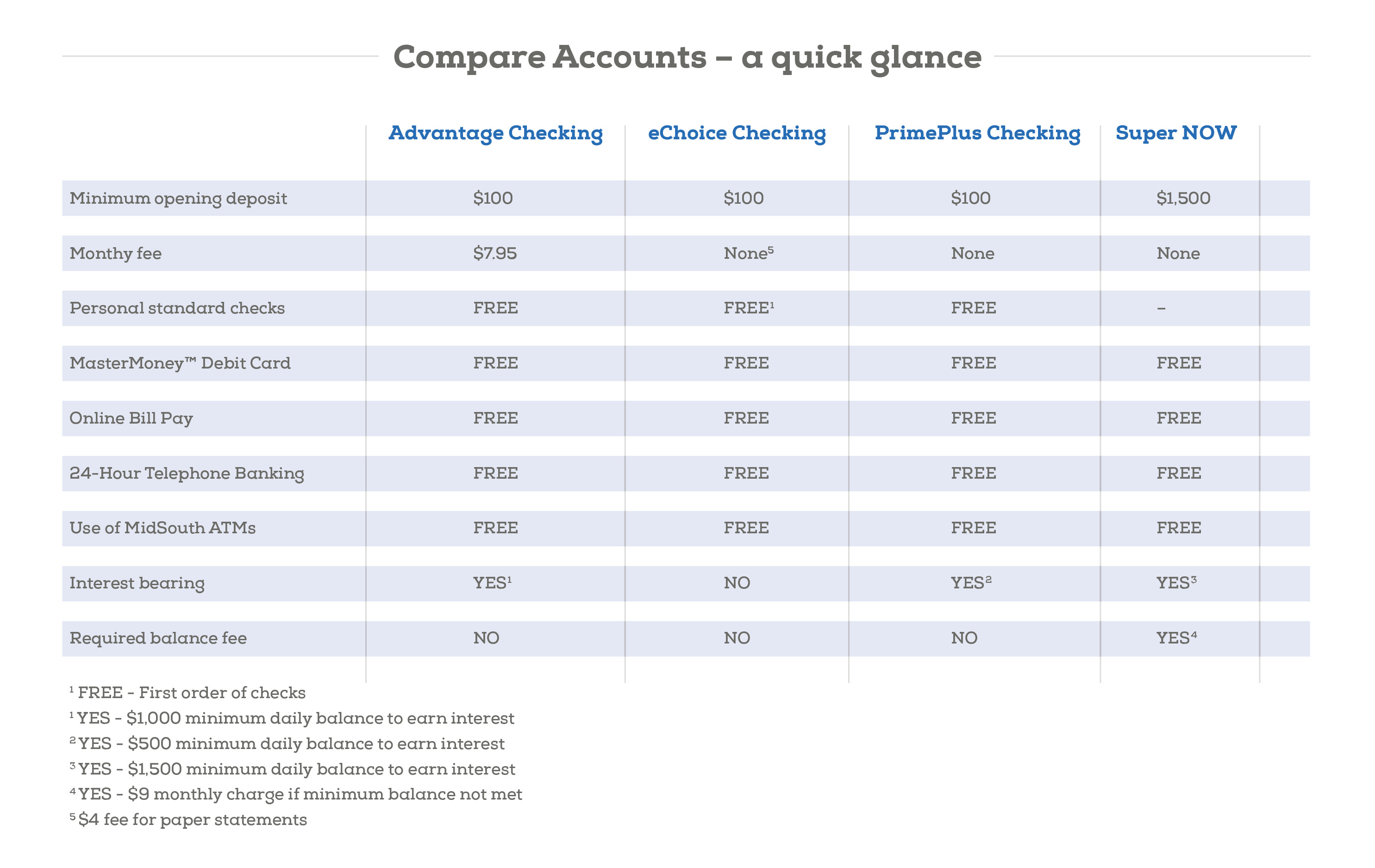

Noble Bank offers various types of checking accounts tailored to different customer needs. For instance, there are accounts specifically designed for students, professionals, and businesses. Each type comes with unique features, such as low or no monthly fees, cashback rewards, and interest-bearing options. This ensures that every customer can find an account that aligns with their financial goals and lifestyle.

Key Characteristics of a Noble Bank Checking Account

- Unlimited check writing and debit card transactions

- Online and mobile banking access

- Direct deposit options

- Overdraft protection

- No minimum balance requirements for certain account types

These features make Noble Bank Checking Account a popular choice for individuals seeking a reliable and flexible banking solution.

Benefits of a Noble Bank Checking Account

Choosing the right checking account can have a significant impact on your financial well-being. Noble Bank Checking Account offers a range of benefits that set it apart from other financial institutions. Below, we’ll explore the key advantages of opening an account with Noble Bank.

1. Low or No Monthly Fees

One of the standout features of Noble Bank Checking Account is its affordability. Many account types come with no monthly maintenance fees or low fees that are easy to waive by meeting simple requirements, such as maintaining a minimum balance or setting up direct deposits. This makes it an excellent choice for individuals looking to minimize their banking expenses.

Read also:Remote Iot Vpc Ssh Raspberry Pi A Comprehensive Guide For Secure And Efficient Connectivity

2. Advanced Digital Banking Tools

Noble Bank invests heavily in technology to provide its customers with cutting-edge digital banking tools. These include a user-friendly mobile app, online bill payment, and real-time transaction alerts. Such features empower account holders to manage their finances conveniently and efficiently from anywhere in the world.

3. High Level of Security

Security is a top priority for Noble Bank. The institution employs advanced encryption technology and multi-factor authentication to protect your account from unauthorized access. Additionally, customers can monitor their account activity 24/7 and receive instant notifications for suspicious transactions.

4. Excellent Customer Support

Noble Bank prides itself on its exceptional customer service. Whether you need assistance with account setup, resolving issues, or understanding fees, their support team is available via phone, email, or live chat. This ensures that customers always have access to the help they need.

How to Open a Noble Bank Checking Account

Opening a Noble Bank Checking Account is a straightforward process that can be completed in just a few steps. Whether you prefer to apply online or visit a branch, Noble Bank makes it easy to get started. Here’s a step-by-step guide to help you open your account:

Step 1: Choose the Right Account Type

Noble Bank offers several checking account options, each tailored to specific customer needs. Take some time to review the features and benefits of each account type to determine which one best suits your requirements. For example, if you’re a student, you may opt for the Student Checking Account, which typically comes with no monthly fees and additional perks like cashback rewards.

Step 2: Gather Required Documents

To open a checking account, you’ll need to provide certain documents and information. These typically include:

- Valid government-issued ID (e.g., passport, driver’s license)

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Proof of address (e.g., utility bill, lease agreement)

- Initial deposit amount (if applicable)

Step 3: Submit Your Application

You can submit your application online through Noble Bank’s secure website or in person at a local branch. The online application process is quick and convenient, allowing you to upload your documents and complete the necessary forms in minutes. If you choose to visit a branch, a representative will guide you through the process and answer any questions you may have.

Step 4: Activate Your Account

Once your application is approved, you’ll receive your account details, including your account number and debit card. You can then activate your account and start using it to manage your finances. Noble Bank also provides resources to help you get started, such as tutorials on using their mobile app and setting up online banking.

Features of Noble Bank Checking Account

Noble Bank Checking Account is packed with features designed to enhance your banking experience. Below are some of the standout features that make this account a top choice for customers:

1. Mobile Check Deposit

With Noble Bank’s mobile app, you can deposit checks directly into your account using your smartphone. Simply take a photo of the check, and the funds will be credited to your account within a few business days. This feature eliminates the need to visit a branch or ATM, saving you time and effort.

2. Overdraft Protection

Noble Bank offers overdraft protection to help you avoid costly fees and declined transactions. This feature links your checking account to a savings account or line of credit, ensuring that funds are automatically transferred to cover any shortfall. Overdraft protection provides peace of mind and helps you maintain a positive financial reputation.

3. Cashback Rewards

Some Noble Bank Checking Account types offer cashback rewards on debit card purchases. This allows you to earn money back on everyday spending, such as groceries, gas, and dining out. Cashback rewards are a great way to maximize the value of your account and save money over time.

4. Interest-Bearing Options

For customers seeking to earn interest on their checking account balance, Noble Bank offers interest-bearing checking accounts. These accounts provide a competitive interest rate, allowing you to grow your money while maintaining liquidity. This is an excellent option for individuals who want to combine the benefits of a checking and savings account.

Fees and Charges

While Noble Bank Checking Account is known for its affordability, it’s important to understand the fees and charges associated with the account. Below is a breakdown of the most common fees:

1. Monthly Maintenance Fee

Most Noble Bank Checking Accounts have no monthly maintenance fee, but some account types may require you to meet specific requirements to avoid the fee. For example, maintaining a minimum balance or setting up direct deposits can help you waive the fee.

2. Overdraft Fees

If you overdraw your account and do not have overdraft protection, Noble Bank may charge an overdraft fee. The exact amount varies depending on the account type and the number of overdraft occurrences. However, the bank provides tools and resources to help you avoid overdraft situations.

3. ATM Fees

Noble Bank offers a network of fee-free ATMs for its customers. If you use an out-of-network ATM, you may incur a fee. To minimize ATM fees, it’s best to use Noble Bank’s ATM network or partner banks.

4. Account Closure Fee

If you close your account within a certain period (e.g., 90 days), Noble Bank may charge an account closure fee. This fee is typically minimal but is worth considering if you plan to switch banks shortly after opening your account.

How to Manage Your Noble Bank Checking Account

Effectively managing your Noble Bank Checking Account is key to maximizing its benefits and avoiding unnecessary fees. Here are some tips to help you stay on top of your finances:

1. Monitor Your Account Regularly

Use Noble Bank’s mobile app or online banking platform to track your account activity. Regular monitoring allows you to spot any discrepancies or unauthorized transactions early, helping you resolve issues promptly.

2. Set Up Alerts

Noble Bank offers customizable alerts that notify you of important account activity, such as low balances, large transactions, or bill payments. Setting up alerts ensures that you’re always aware of your financial status and can take action when needed.

3. Automate Your Finances

Take advantage of Noble Bank’s automation tools to streamline your financial management. You can set up automatic bill payments, direct deposits, and savings transfers to ensure that your finances run smoothly without manual intervention.

4. Review Statements Monthly

Make it a habit to review your monthly statements to understand your spending patterns and identify areas for improvement. This practice helps you stay on track with your financial goals and avoid unnecessary expenses.

Security and Protection

Noble Bank prioritizes the security of its customers’ accounts, implementing robust measures to protect your funds and personal information. Below are some of the key security features offered by Noble Bank:

1. Encryption Technology

All transactions and communications between you and Noble Bank are encrypted using advanced technology. This ensures that your data remains secure and cannot be intercepted by unauthorized parties.

2. Multi-Factor Authentication

Noble Bank requires multi-factor authentication for online and mobile banking access. This adds an extra layer of security by requiring you to verify your identity through multiple methods, such as a password and a one-time code sent to your phone.

3. Fraud Monitoring

Noble Bank employs sophisticated fraud detection systems to monitor account activity for suspicious behavior. If any unusual activity is detected, the bank will notify you immediately and take steps to protect your account.

4. Zero Liability Policy

Noble Bank’s zero liability policy ensures that you are not held responsible for unauthorized transactions made with your debit card or account. This provides peace of mind and protects you from financial loss in the event of fraud.

Customer Support

Noble Bank is committed to providing exceptional customer support to its account holders. Whether you have a question about your account, need assistance with a transaction, or want to learn more about the